A Watershed Moment: Part III

The Walmart Impact

This is the third installment in an ongoing Velocity Commerce Group series that examines the impact COVID-19 is having on the future of online grocery.

Joe Scartz

Chief Digital Commerce Officer

Joe Scartz is an accomplished marketing executive, and as Velocity Commerce Group’s fearless leader, he is responsible for overseeing all digital commerce strategy and execution, including mobile, social, and traditional e-commerce.

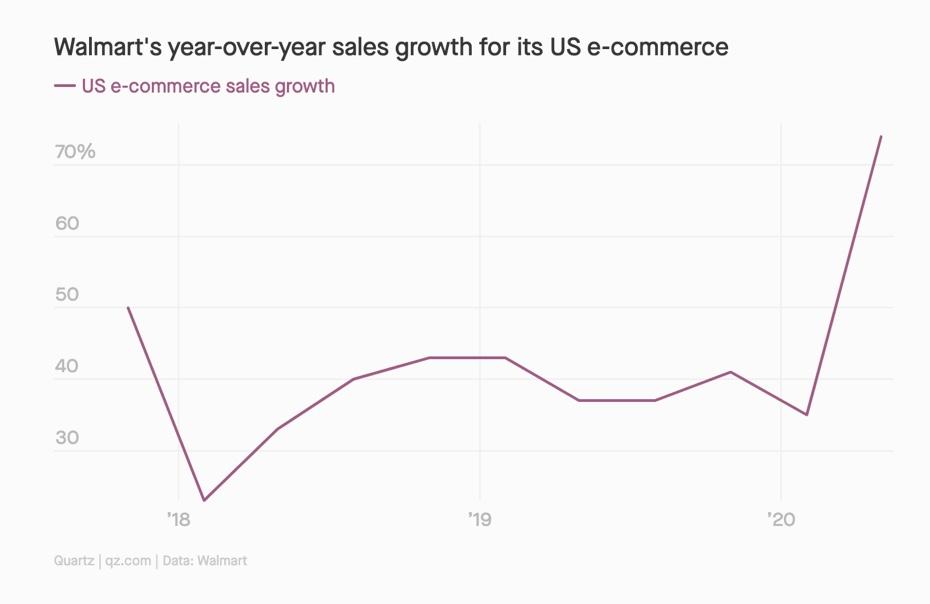

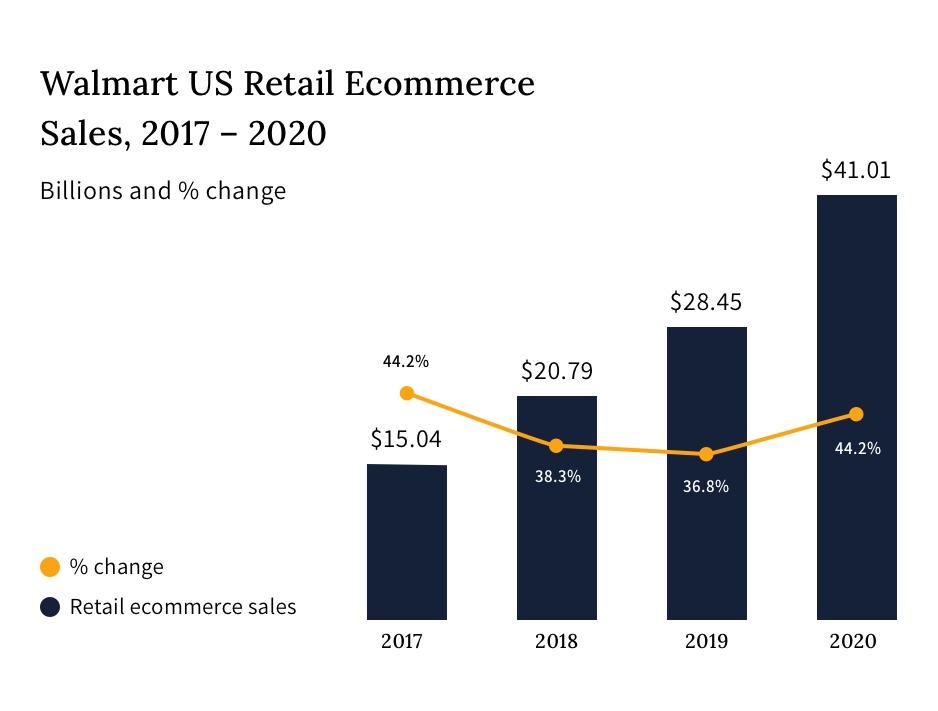

Let there be no mistake, Walmart Grocery is in the process of changing the way people shop the channel, forever. Recently we have seen some pretty astounding ecommerce numbers come out of Bentonville. When Walmart reported earnings on May 19th, it was widely reported that their total ecommerce sales grew an astronomical 74% YOY in the most recent quarter. That growth represents a re-acceleration of their overall ecommerce sales growth which was declining, from admittedly, very high levels.

Caption: Nulla quis condimentum mauris. Quisque pellentesque justo est, nec hendrerit augue pharetra non.

However, beneath that headline were some eye-opening numbers that further support our thesis that the grocery business will soon reach and remain above 10% of total category spend, annualized. Of course, Walmart is the largest grocer in the United States, so when thinking about the total category (and of course similar trends at Kroger, Albertsons, Target and to some extent, Amazon) the points below support our thesis even more:

Caption: Nulla quis condimentum mauris. Quisque pellentesque justo est, nec hendrerit augue pharetra non.

- More than half of purchases made on Walmart.com were groceries in the first quarter, according to researcher M Science, up from 38% at the end of last year.

- In the quarter, Walmart abandoned their stand-alone grocery app in favor of a single integrated Walmart app. If they are successful in getting shoppers to shop general merchandise more, they will further improve margins.

- The number of new Walmart customers trying pickup and delivery was up four times since mid-March, with pickup available in over 3,000 stores.

- Walmart (like others) has solved early problems with delivery availability and many inventory issues by tweaking their inventory management and hiring thousands of additional associates in an effort to meet the increase in demand and change in shopping behavior.

- In early May Walmart unveiled “Express Delivery” which will allow for 2-hour shipping on more than 160,000 items from across Walmart’s grocery, consumables and general merchandise categories.

When taken collectively, all of the above actions will deepen engagement and enhance the online grocery customer experience for Walmart shoppers. Walmart is not the whole story; they are only the leader. But in this case, the leader speaks volumes about where online grocery is headed.”

— Attribution

When taken collectively, all of the above actions will deepen engagement and enhance the online grocery customer experience for Walmart shoppers. Walmart is not the whole story; they are only the leader. But in this case, the leader speaks volumes about where online grocery is headed.

To learn more about Velocity Commerce Group and how we can help you win the grocery ecommerce wars, please reach out to us on LinkedIn, at our website. Let’s Talk!

Contact Us

Let’s Talk

Find out how we can create value for your business and drive your commerce performance forward.