Grocery Ecommerce:

A Watershed Moment, Part II

Hypothesis:

Back on March 17th, I wrote that grocery ecommerce was experiencing a watershed moment based on a couple of weeks of data and only a few days after nation-wide shelter-in-place guidelines were issued. There has been some debate as to whether or not this is truly the case. I believe it is the case and believe this more-so-even than I did on March 17th. In that spirit, let’s take a look back at some of the historic numbers we’ve seen across the grocery ecommerce landscape and take a detailed view of the path ahead. Grocery ecommerce is, in fact, here to stay…and will thrive.

Joe Scartz

Chief Digital Commerce Officer

Joe is an accomplished marketing executive, and as our fearless leader, is responsible for overseeing all digital commerce strategy and execution.

With more than 20 years of success for brands such as Harley-Davidson, United, Budweiser, Clorox, and Hershey, Joe has an impressive history of helping agencies and Fortune 500 companies meet their strategic and financial goals.

More Points of Entry:

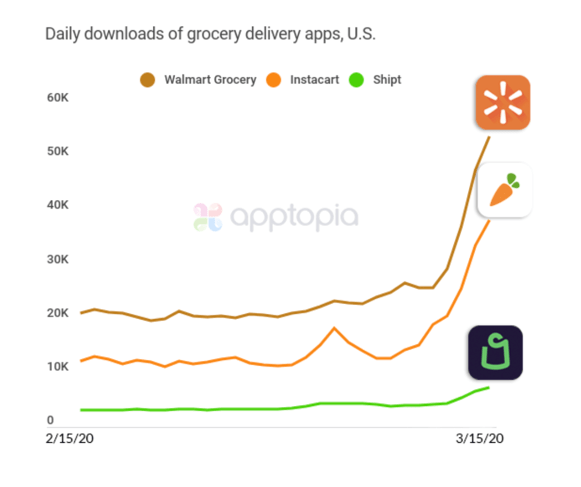

It goes without saying that we aren’t getting out to shop as much these days. Therefore, the manner in which consumers are shopping is increasingly digital in nature. The most often-cited app download chart from Apptopia accentuates how true that was for ecommerce grocery in the frantic first days of the pandemic. Apptopia noted that The Walmart Grocery App, Shipt and Instacart were downloaded between 124% and 218% more month over month. Consumers quickly established new ways to source groceries and have them delivered.

Apptopia monitoring daily downloads of grocery delivery apps, US

BOPIS Gains Traction:

As consumers procured more digital access to grocery they also took advantage of the buy-online-pick-up-in-store (BOPIS) trend that was already growing according to TPN, the Creative Commerce Agency, and other sources.

The consumer response to COVID-19 accelerated this trend dramatically, with a surge of 62% YOY between Feb 24th and March 21st, according to Adobe’s report.

Armed with BOPIS, Apps, and Amazon, Consumers Rushed to Grocery Ecommerce:

Clearly, retail is challenged in unbelievable ways at the moment, and will continue to be in the coming days, weeks and months. However, in the second half of March the sale of consumer goods benefited from the unprecedented shift in priorities and dollars as a result of COVID-19. According to Nielsen, consumer goods sales surged 67.9% YOY for the week ending March 21st and for the week ending March 28th were up 21.5% YOY. These significant increases were initially the result of hoarding and have slowed but still exemplify where consumers are shifting their dollars as they shelter-in-place. As a result of this macro-shift, grocery ecommerce, enabled via app, mobile and website distribution plus BOPIS, experienced explosive growth in new customers and from repeat customers.

Let’s break it down:

- According to Adobe: Overall ecommerce grew during the March 13-15th timeframe by 25% vs. the March 1st -11th timeframe. The same report stated that daily ecommerce grocery sales doubled YOY during the same time frame.

- Additionally, Rakuten Intelligence reported that the BOPIS and delivery dollar value of orders from full-assortment grocers was up 210%, while the number of orders grew 151%. Zooming out to a longer time period, from Jan 1 – March 15th, sales increased 61% and the number of orders grew nearly 58% YOY.

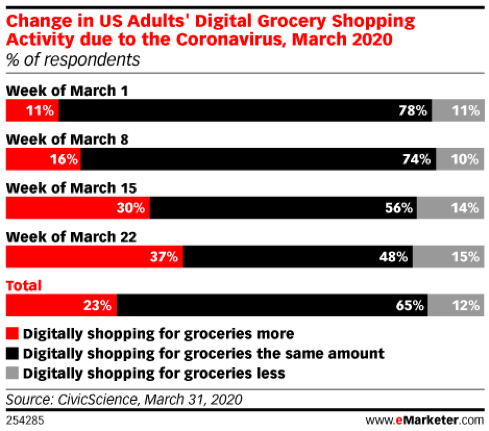

- In a CivicScience poll of US adults and their digital grocery shopping habits, the percentage of those who said they increased their online grocery shopping jumped from 11% to 37% from March 1st to 22nd.

US Adults Digital Grocery Shopping Activity during COVID-19, March 2020

As for the retailers themselves, those that support grocery and consumer goods ecommerce saw sales ramp up dramatically:

Walmart

– Walmart sales from its over 4,700 U.S. stores increased nearly 20% over the past four weeks through the beginning of April vs. the year ago period, according to The Wall Street Journal. Additionally, sales on Walmart.com rose over 30% over the past eight weeks.

b. Adding SBV’s is a great way to engage consumers through a unique and new format: scroll stop a shopper, get their attention and have them quickly learn about your product.

i. SBV requirements: 1280×720 (or larger resolution) video for SBV, A video with at least 13 seconds in length, Isolated audio tracks

ii. Target only one ASIN (product)

iii. Cannot link to brand store

iv. Keyword targeted

Amazon

– Rakueten intelligence reported that Amazon Fresh orders were up over 300% YOY in March.

– At the same time, Amazon is being stung by a series of controversies stemming from warehouse conditions and limited (or no) delivery windows available for Amazon Fresh in certain markets like New York City.

– Even Amazon’s vaunted distribution network has not been able to keep up with the demand driven by the Corona Virus forcing delays on Amazon PRIME deliveries across the country.

Target

– Target has revealed that last month’s comparable sales were up more than 20% in the almost four weeks through March 25th, compared with the same period last year. But the sales surge came from food and household goods. Sales of household essentials, food and beverages have risen more than 50% during that time, while sales of apparel and accessories have declined more than 20%.

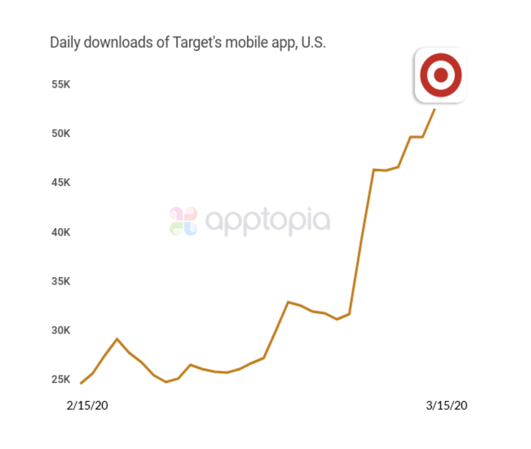

– The downloads of their app increased dramatically, according to Apptopia.

Apptopia, Daily downloads of Target app US

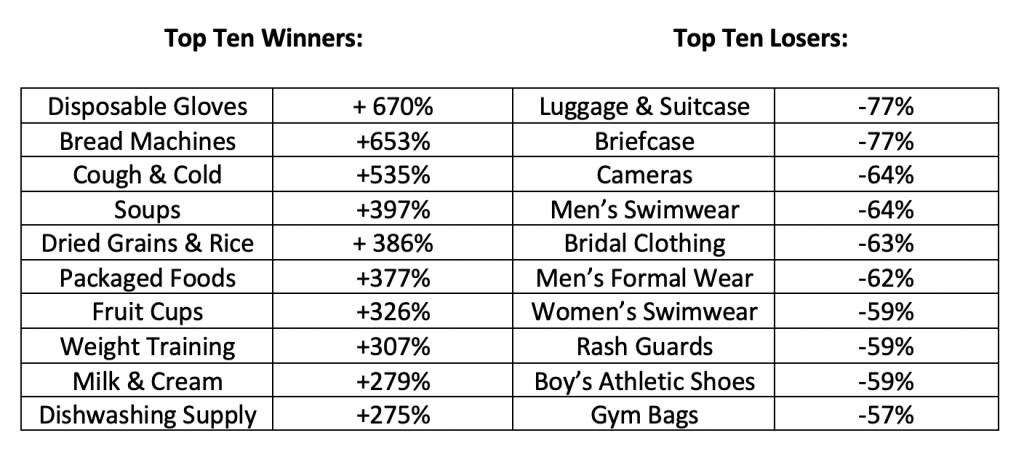

The increase in sales of consumer goods and grocery has created COVID-19 ecommerce winners and losers.

Stackline recently developed a report that looked at the YOY change in ecommerce sales for key categories and products for March, 2020.

COVID-19 ecommerce winners and losers report

Looking Ahead:

These dramatic, and sudden, ecommerce shifts have created tremendous challenges for consumers, shoppers, retailers and brands who are looking to manage their lives in the face of a health and economic crisis. While it is impossible to say precisely when this crisis will end, what we can do is make observations and dare-I-say predictions about where the future lies relative to grocery ecommerce shopping behavior. History and surveys are instructive in these moments, although neither is perfect. Still, we have looked at both and both point to similar patterns. Those patterns suggest that this moment in time will accelerate ecommerce grocery dramatically faster than predicted and that no matter how painful COVID-19 is in terms of human suffering and economic hardship; it does in fact mark a watershed moment for this category.

Historically when there have been major changes to ecommerce shopping behavior like the introduction of Cyber Monday or Amazon PRIME Day, those trends do tend to stick. For years, we have seen ecommerce increase by double digit percentages, with even greater growth in the laggard categories, like grocery over the past few years.

In categories that have deep penetration like electronics, we have seen increased periods of activity drive long-term behavior change. Aditionally, shopper behavior coming out of those periods (Q1 in the holiday shopping example) never again return to the lows of the previous year. Learned activity becomes habitual.

In the case of ecommerce grocery shopping, current conditions have abruptly injected millions of new shoppers into the ecommerce ecosystem. Some (not all) shoppers have had frustrating and confusing shopping experiences with no delivery windows, limited or no stock, etc. It is important to note that not all of these experiences have been negative; some have been quite positive. With any rapid expansion, there are growing pains. We have to assume that even if two out of ten new shoppers stick, we are going to see massive growth for this category.

Additionally, the category was already experiencing extreme growth. According to Deutsche Bank the online share of grocery sales was already around 5% and on pace to reach 6% by the end of this year, even before Corona Virus. In various countries in Europe and Asia the number is already much higher than that. So, inertia (and heavy investment) was at work already; now that inertia has been given a significant shot in the arm.

Fabric, a fulfillment company, recently released a survey where they stated that online grocery in the US could be close to 10% of total grocery sales in the US, as early as this year. Their survey of 1000 consumers stated that 52% of consumers have shopped for groceries online because of the pandemic.

Fabric shared that 70% of consumers surveyed said they are likely to continue shopping online, as a result of COVID-19. Even more pivotal in terms of growth, the Fabric survey stated that 51% of those who have never ordered groceries online will do so in the near future because of the virus.

So, depending on how long the shelter-in-place orders stay in effect and assuming that online grocery logistics continue to improve as the retailers and delivery services continue to ramp up, you can make the case (and I am) that many of these customers will remain, despite poor experiences which in the short term they might be willing to forgive…considering the circumstances. And for those retailers that actually exceed shopper expectations, they will gain some new customers for life.

Now is the watershed moment for online grocery ecommerce.

Now is the watershed moment for online grocery ecommerce. We were one of the first to say it and we are going to continue monitoring the situation as shopping behavior evolves and as consumers adjust their sail to stay safe within this pandemic.

To learn more about how Velocity Commerce Group can help, please reach out to us on LinkedIn, at our website, or directly to me.

Contact Us

Let’s Talk

Find out how we can create value for your business and drive your commerce performance forward.